4H Chart

4H swing is bullish. Internal is bullish too.

At the moment, we’re observing a pullback within the 4H internal trend following the most recent internal break of structure. There are currently two points of interest (PoIs):

- A demand zone that initiated the last internal bullish break, where price may return before continuing higher, and

- A supply zone above, which we anticipate will eventually fail if the 4H bullish trend is to remain intact.

Although we expect this supply zone to be broken, it’s still possible that the next internal pullback begins from this area.

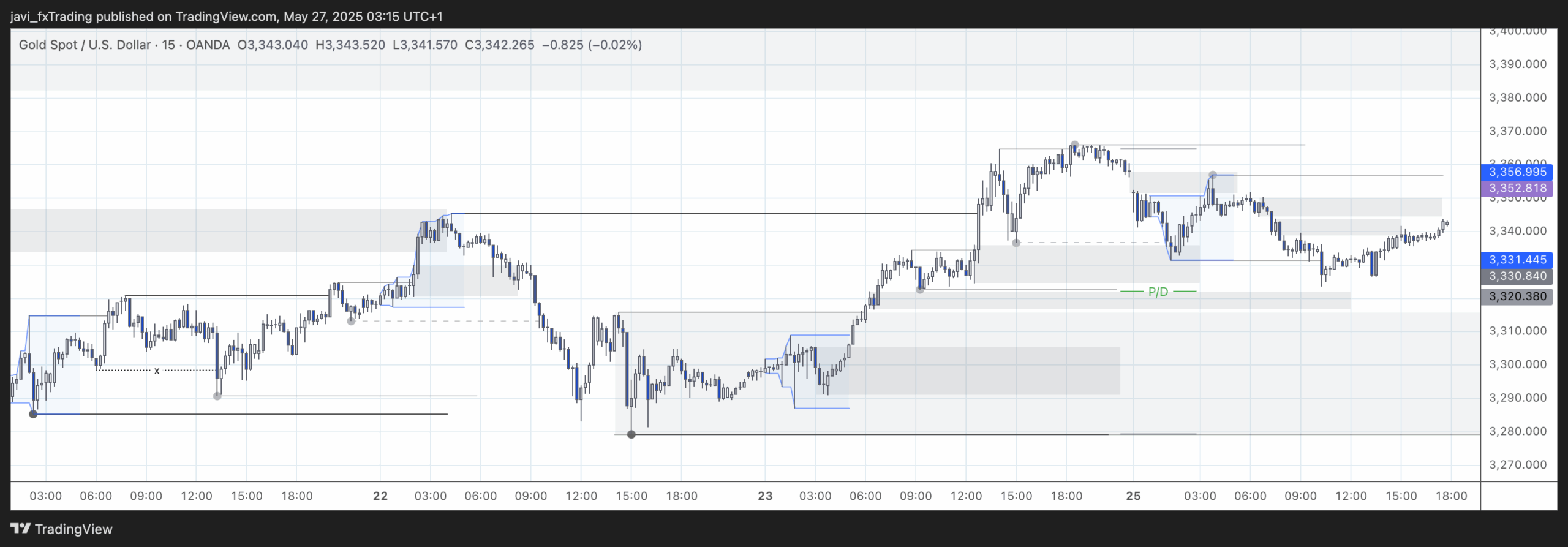

15min Chart

15min swing is bullish. Internal is bearish after the break during Asia session.

During Friday’s session, the internal structure was initially bearish, but shifted to bullish, giving us the next bullish leg. Toward the end of the session, a new swing high was established, and now we’re seeing a return to bearish movement.

I’ve highlighted the premium and discount zones of that last bullish leg. Price began dropping toward the point of interest (PoI) in the discount zone but failed to reach it.

Let’s take a closer look at the session’s price action. It’s worth noting that U.S. markets were closed, so volume was low, and the session effectively ended around London lunchtime.

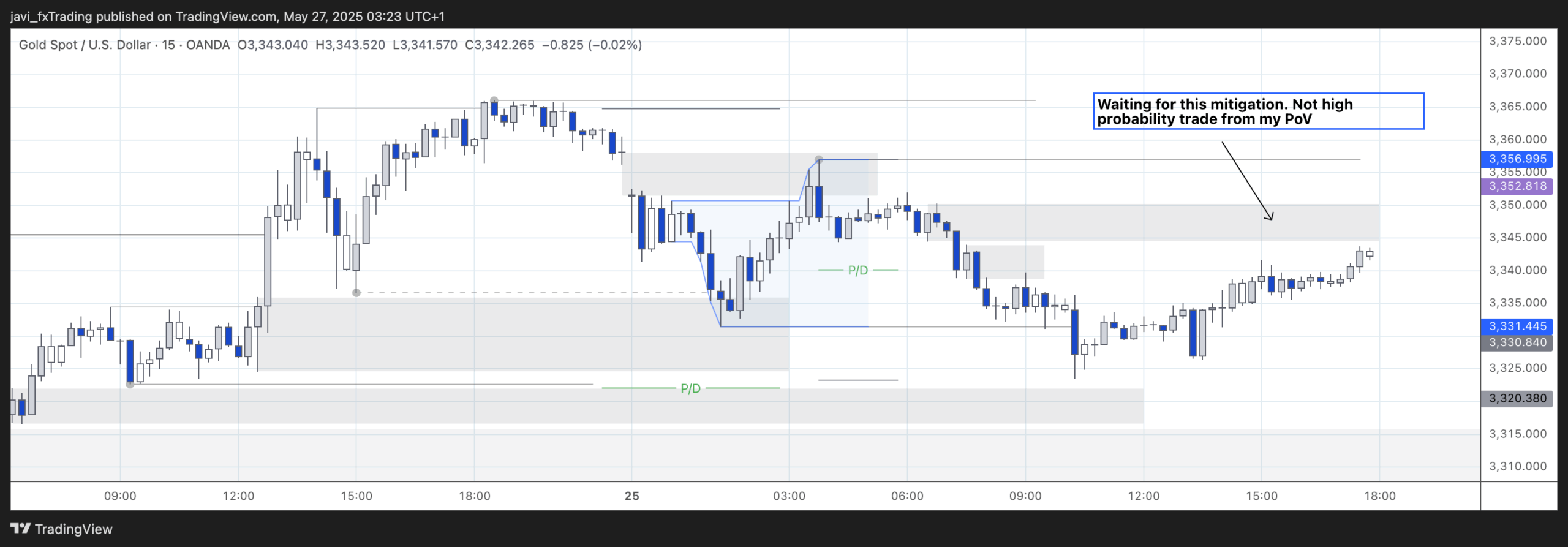

Session Outlook and Entries

In this session, I was waiting for a break of the Asia low — the current internal weak low — to get a fresh point of interest (PoI) to short from. Price is already near the equilibrium (EQ) of the swing leg, so any opportunity to trade may be short-lived, as the trend could flip to resume the 15-minute bullish swing.

I’ve marked the premium and discount zones of the last internal leg. After the break of the Asia low, I identified two PoIs: one at the extreme of the leg (typically higher probability), and another at a small pause in price action. That second zone was already mitigated before the Asia low was broken.

I didn’t bother marking the PoI just before the break, as it sits in the discount zone and I’m not interested in shorting near a newly formed weak low.

Price failed to reach the demand zone within the discount of the swing leg, as well as the 4H demand just below. It began moving higher again and eventually stalled out toward the end of the London session, with U.S. markets closed.

I’ll be monitoring this area, though I don’t consider it high probability. Price already came close to the EQ of the swing leg, so continuation of the bullish trend is likely. That said, there’s still potential liquidity below the EQ, considering the newly formed weak internal low and the small range to the left.

Final Thoughts

- When all higher timeframes align bullish — in this case, the 4H swing, 4H internal, and 15min swing — short setups become riskier and require extra caution.