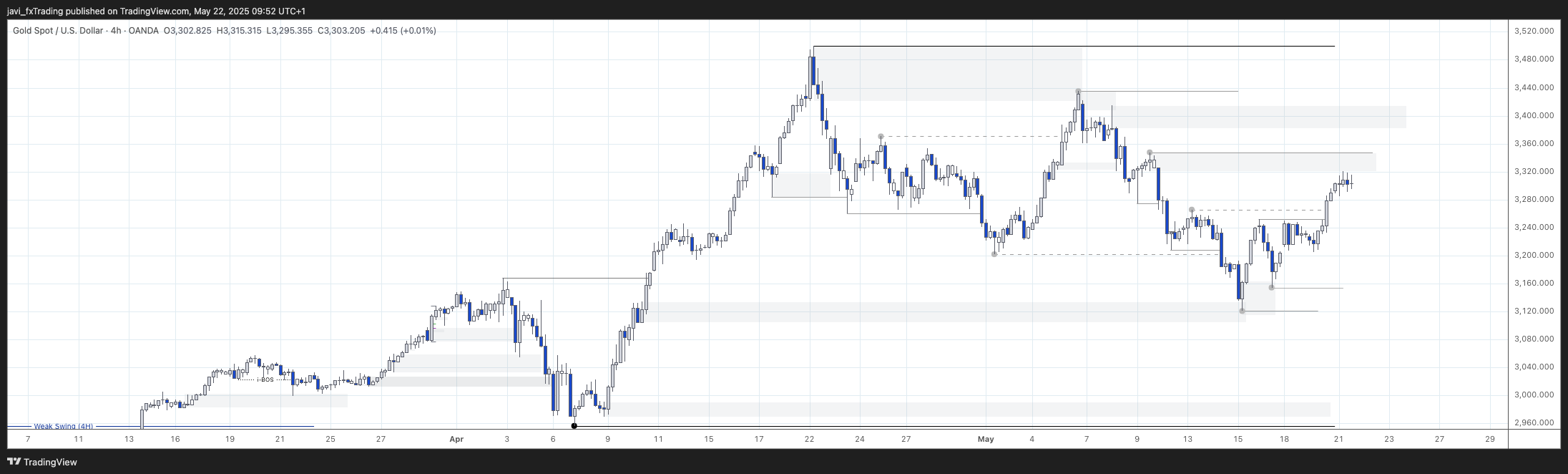

4H Chart

4H swing is bullish. Internal is bullish.

Looking at the most recent price action, after price broke up with strength in the previous session and took all the liquidity accumulated in that area, price is now settling at the top of last week opening gap (visible in the 15min chart).

After the PoI created in the opening gap, only one more PoI is on the way to the strong high (all time high at 3,500) as the extreme one has been already mitigated. The area is quite big though so there could be some orders still sitting in that area.

At this point we could take a look at the daily chart and see that it is bullish and the pullback (daily pullbacks are normally 4H bearish trends) may have finished (price already in the discount of the leg) so price could continue to all time highs again taking the 4H strong swing high on its way.

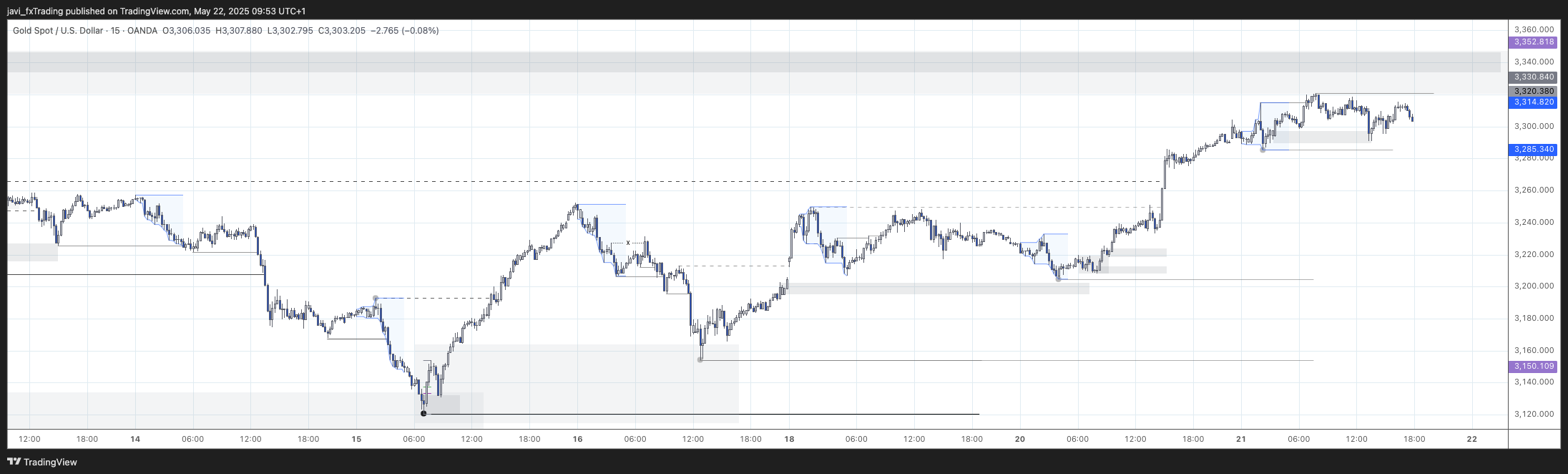

15m Chart

15min swing is bullish. Internal is bullish too.

Price broke the strong swing high in the previous session realigning with the 4H internal. For this session, price is reaching a 4H PoI with a stacked 15m PoI. A 15m pullback is expected after the break of structure but price could continue higher until we see some bearish change.

Session Outlook and Entries

Bias for the session is bullish following the 15m internal structure. We need to keep in mind that we are reaching a 4H supply area which could cause the 15m swing pullback.

Considering the outlook, I only considered the PoI at the extreme of the internal range. A low was taken (there is liquidity resting under lows) so this could power the next leg. I did not take this trade as I was trading USDJPY pair so I was not looking at this setup in detail. Enter at the edge of the PoI, SL would have been just under the internal low and TP before the 15m PoI within the 4H PoI for a 2.6 R:R. The target was reached next day during early hours of Asia session, not great if you don’t like keeping open trades overnight but still valid.

Final Thoughts

- Overall, not the highest probability trade but still in line with the swing and internal structure, all depends on your risk tolerance.

- Going for the extreme PoI provides a bit more confidence in this type of setups: after the 15m weak swing high break (pullback can start at any moment) and near a higher timeframe supply area