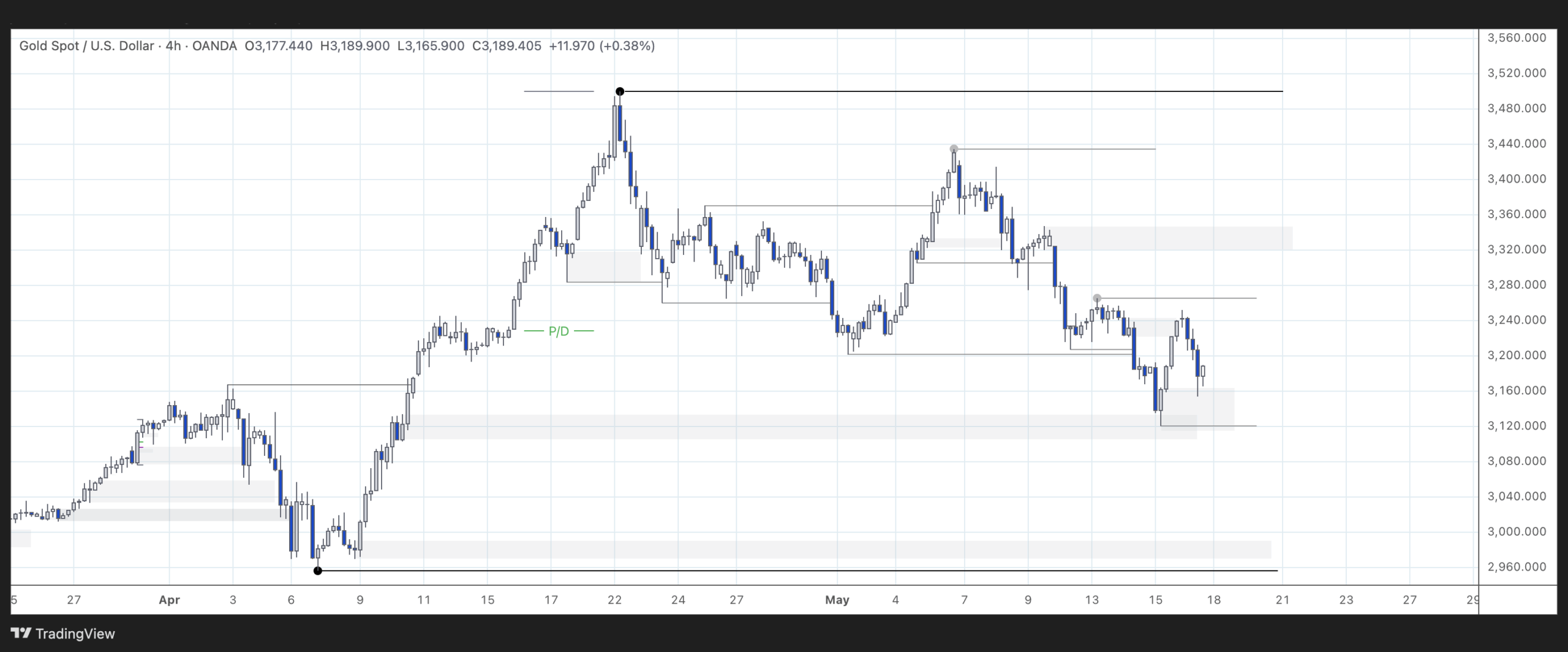

4H Chart

4H swing is bullish. Internal is bearish.

In the more immediate price action, price mitigated a demand area already in the discount of the leg. The reaction was relatively strong with four bullish candles but the internal high seems to be holding and price pulled back moving towards the weak low. If the weak low holds this could be the start of the continuation of the 4H swing or we will likely fall to the extreme support around 3,000.

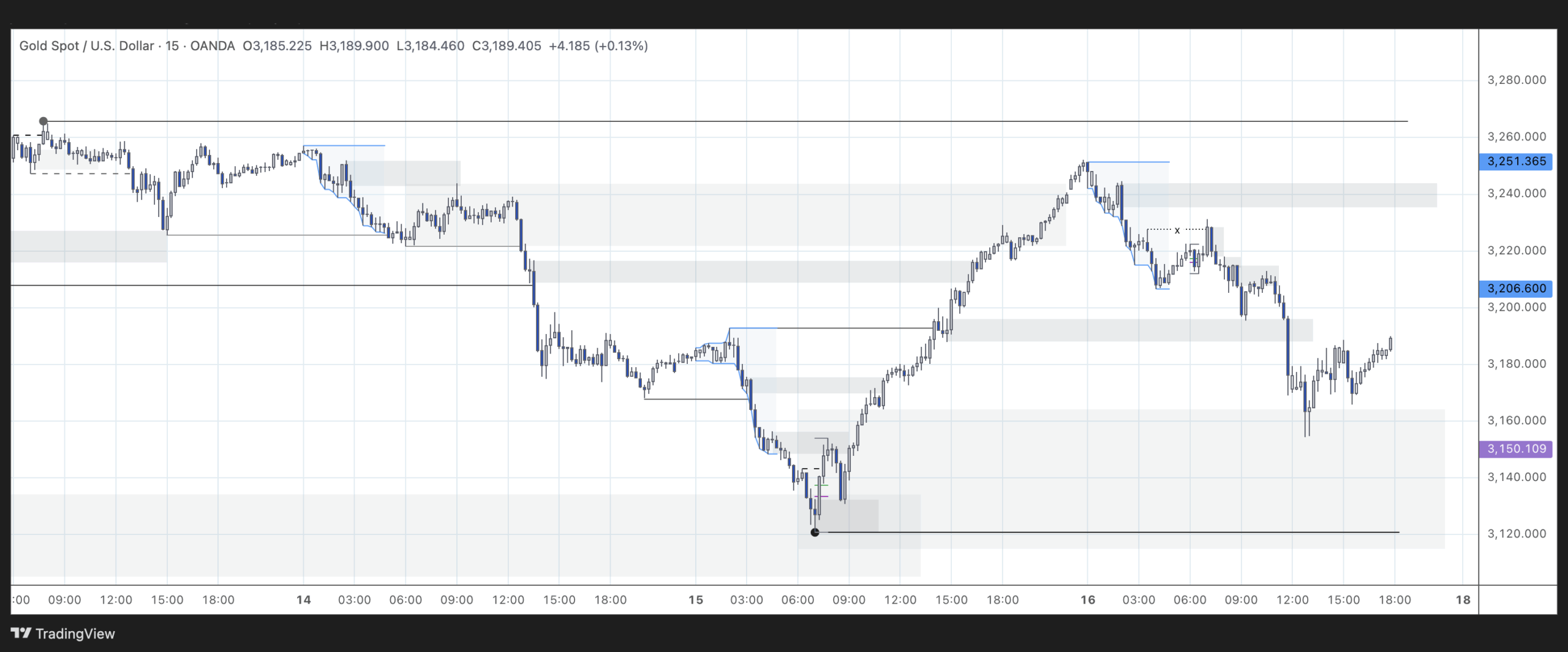

15m Chart

15m swing is bearish. Internal is bullish.

After the reaction on the 4H demand area, price moved up quite vertically although I dont see big candles there creating clear PoIs. It reached the extreme of the swing range, turning back around the PoI on the left that I did not extend all the way due to the wick touch. The expectation before the session was to see some pullback after the long leg up.

Session Outlook and Entries

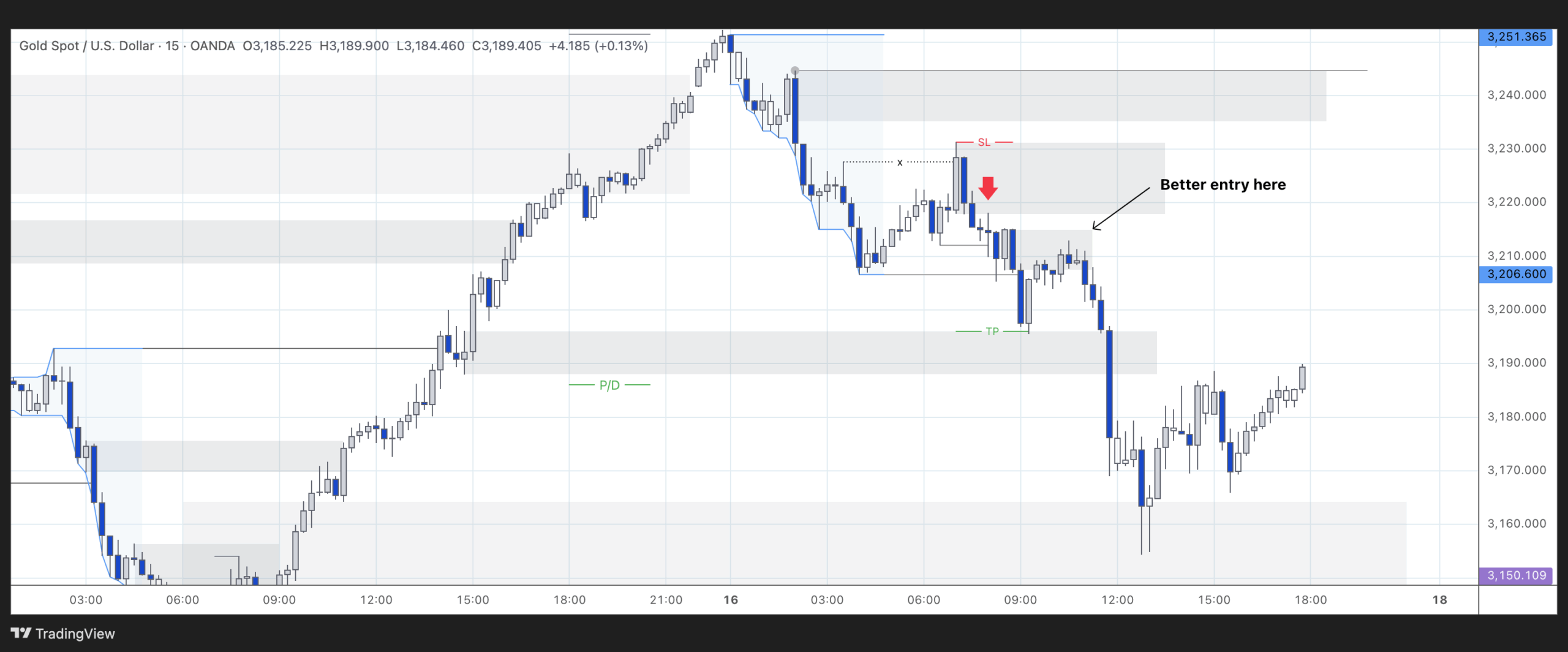

Bias for the session was bearish towards the discount of the range. I identified one PoI formed during Asia session.

As the session started a strong candle up was quickly rejected by a strong candle down. It did not reach my PoI but I noticed a liquidity sweep (dotted line with x). I took my chances on the retest of the newly formed supply area although it did not break any structure yet so it was not great. I targeted the PoI below for a quick 1.6 R:R.

A better entry would have been to wait for the break of structure (Asia low) and a retest of another supply are that formed (the most immediate one that cause the Asia low break). The issue would have been the TP as there is an area below that already showed some resilience but still located in the premium of the range so, less likely to hold.

Final Thoughts

- I need a bit more specific entry rules. I feel this entry was more an attempt of not missing out rather than a rule-based entry, for example, the PoI should have broken some structure for me to consider trading from it.

- I still feel I can leave more room for profits to run. Memories of trades turning back on me are still fresh but as long as the price structure supports the trade I should not fear taking a bit more from the market.