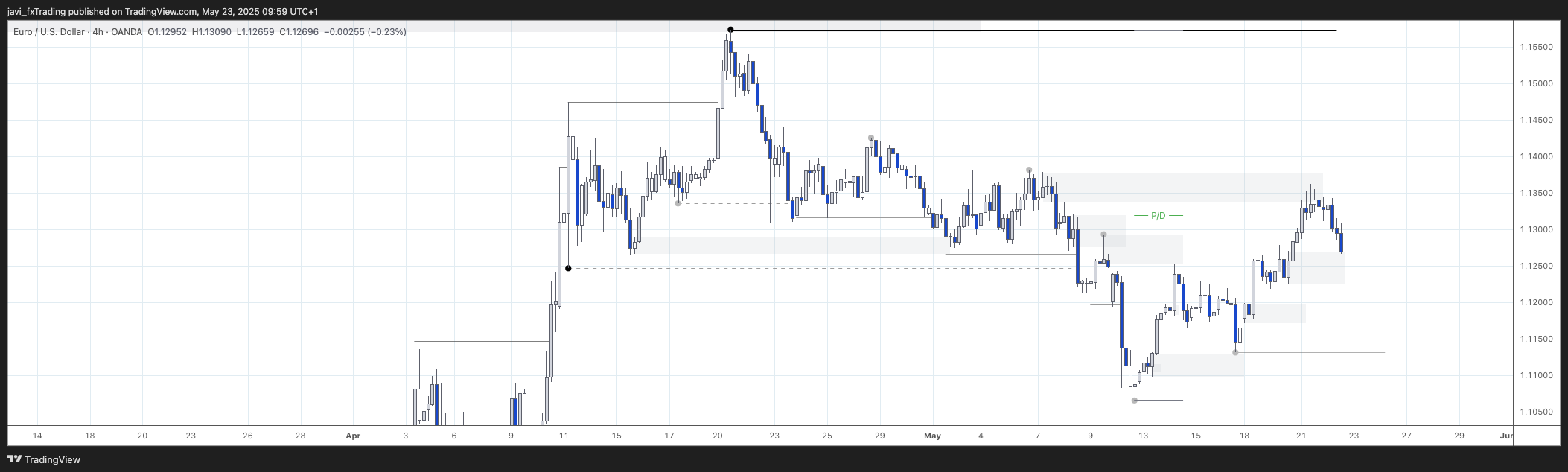

4H Chart

4H swing is bearish. 4H internal is bullish.

Price continued its way up and showed rejection from a supply area already in the premium of the bearish 4H swing leg. This only means that the 4H bearish trend may resume but for now, let’s follow the internal structure until something changes.

15min Chart

15min swing is bullish. Internal is bullish at the beginning of the session but it will change to bearish during the session.

For now, we are just seeing the 15min swing pullback that started in a 15min area stacked inside a 4H supply area which is normal turning point for pullbacks (higher timeframe PoI to the left). I have marked the premium and discount area.

Session Outlook and Entries

Bias for the session is neutral favoring shorts considering the 4H supply area that price reached yesterday. However, internal is still bullish so, for shorts, I would like a PoI from where prices break the internal low. For longs, I would like the price to reach at least the EQ.

The first PoI highlighted did not manage to break (body break) the strong internal low. It provides though a valid entry if you have mapped the structure a bit tighter or if a wick break is enough for you. SL would have been just a couple of pips over the area and TP just before the demand area in the EQ of the swing leg for a 2.5 R:R. I would be mindful though about the Asia high just over it as EURUSD sometimes takes this liquidity available before starting the real move.

The area I was looking for formed after the mitigation of this area. As the buy to sell candle had a long wick, I refined to the insider bar just after it (white candle). Unfortunately, price did not retrace back to it so, no entry for me.

Refining areas is a trade off between missing the trade and achieving better R:R. If you had taken the entire bullish candle before (also explained in the picture), TP would have been past the EQ just before the 4H demand area below for a 1.5 R:R, maybe not that bad. That was a winning trade, though the outcome of any individual trade is essentially random. What truly matters is understanding the setup and how Points of Interest (PoIs) can be drawn to maximize the risk/reward ratio and profit factor over time.

About longs, after the internal structure switching bearish, it was a bit risky to go long from the PoI in the EQ, some of the reasons could have been:

- Internal structure just switched bearish.

- PoI formed during Asia. These PoIs are less reliable as the volume during Asia session is much lower.

- All the liquidity resting below the strong internal low (and another low at the beginning of Asia session) was just taken by the lowest candle of the previous small swing (bearish candle with a long wick). This was then broken which indicates little buying pressure nearby the narrow PoI in EQ.

Final Thoughts

- In this case, I’m happy I stuck to my rules, even if it meant missing a trade. Over the long run, this helps me avoid unnecessary losses.

- Price action was quite range-bound during the previous session, which didn’t give me enough confidence to start shorting.